MonteCarloOption

> mc <- MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000,+ mcLoops = 50, init = TRUE, innovations.gen = sobolInnovations,

+ path.gen = wienerPath, payoff.calc = arithmeticAsianPayoff,

+ antithetic = TRUE, standardization = FALSE, trace = TRUE,

+ scrambling = 2, seed = 4711)

|

| Add caption |

Monte Carlo Simulation Path:

Loop: No Error in MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000, :

object 'sobolInnovations' not found

> sobolInnovations <- function(mcSteps, pathLength, init, ...) {

+ # Create and return Normal Sobol Innovations:

+ rnorm.sobol(mcSteps, pathLength, init, ...)

+ }

> wienerPath <- function(eps) {

+ # Note, the option parameters must be globally defined!

+ # Generate and return the Paths:

+ (b-sigma*sigma/2)*delta.t + sigma*sqrt(delta.t)*eps

+ }

> plainVanillaPayoff <- function(path) {

+ # Note, the option parameters must be globally defined!

+ # Compute the Call/Put Payoff Value:

+ ST <- S*exp(sum(path))

+ if (TypeFlag == "c") payoff <- exp(-r*Time)*max(ST-X, 0)

+ if (TypeFlag == "p") payoff <- exp(-r*Time)*max(0, X-ST)

+ # Return Value:

+ payoff

+ }

> arithmeticAsianPayoff <- function(path) {

+ # Note, the option parameters must be globally defined!

+ # Compute the Call/Put Payoff Value:

+ SM <- mean(S*exp(cumsum(path)))

+ if (TypeFlag == "c") payoff <- exp(-r*Time)*max(SM-X, 0)

+ if (TypeFlag == "p") payoff <- exp(-r*Time)*max(0, X-SM)

+ # Return Value:

+ payoff

+ }

> TypeFlag <- "c"; S <- 100; X <- 100

> Time <- 1/12; sigma <- 0.4; r <- 0.10; b <- 0.1

>

> mc <- MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000,

+ mcLoops = 50, init = TRUE, innovations.gen = sobolInnovations,

+ path.gen = wienerPath, payoff.calc = arithmeticAsianPayoff,

+ antithetic = TRUE, standardization = FALSE, trace = TRUE,

+ scrambling = 2, seed = 4711)

Monte Carlo Simulation Path:

Loop: No

Loop: 1 : 3.253438 3.253438

Loop: 2 : 2.635154 2.944296

Loop: 3 : 2.6733 2.853964

Loop: 4 : 2.748978 2.827718

Loop: 5 : 2.795612 2.821296

Loop: 6 : 2.904628 2.835185

Loop: 7 : 2.76193 2.82472

Loop: 8 : 2.943871 2.839614

Loop: 9 : 3.628506 2.927269

Loop: 10 : 3.549677 2.989509

Loop: 11 : 2.623178 2.956207

Loop: 12 : 3.26091 2.981599

Loop: 13 : 3.206552 2.998903

Loop: 14 : 3.188396 3.012438

Loop: 15 : 3.080368 3.016967

Loop: 16 : 2.469462 2.982748

Loop: 17 : 2.573869 2.958696

Loop: 18 : 2.736678 2.946362

Loop: 19 : 3.275842 2.963703

Loop: 20 : 2.357823 2.933409

Loop: 21 : 2.6898 2.921808

Loop: 22 : 2.780071 2.915366

Loop: 23 : 2.767824 2.908951

Loop: 24 : 3.090034 2.916496

Loop: 25 : 2.520999 2.900676

Loop: 26 : 2.854595 2.898904

Loop: 27 : 3.274827 2.912827

Loop: 28 : 3.588779 2.936968

Loop: 29 : 2.862528 2.934401

Loop: 30 : 2.987253 2.936163

Loop: 31 : 2.726644 2.929404

Loop: 32 : 2.345068 2.911144

Loop: 33 : 2.849574 2.909278

Loop: 34 : 3.391248 2.923453

Loop: 35 : 2.738561 2.918171

Loop: 36 : 3.244874 2.927246

Loop: 37 : 3.337476 2.938333

Loop: 38 : 2.790049 2.934431

Loop: 39 : 2.308579 2.918383

Loop: 40 : 3.427203 2.931104

Loop: 41 : 2.497448 2.920527

Loop: 42 : 2.562182 2.911995

Loop: 43 : 2.821961 2.909901

Loop: 44 : 2.496715 2.900511

Loop: 45 : 2.627413 2.894442

Loop: 46 : 2.676602 2.889706

Loop: 47 : 2.938307 2.89074

Loop: 48 : 3.024983 2.893537

Loop: 49 : 2.443328 2.884349

Loop: 50 : 3.336588 2.893394

> par(mfrow = c(1, 1))

> mcPrice <- cumsum(mc)/(1:length(mc))

> plot(mcPrice, type = "l", main = "Arithmetic Asian Option",

+ xlab = "Monte Carlo Loops", ylab = "Option Price")

>

> if(FALSE) { # ... requires(fExoticOptions)

+ TW <- TurnbullWakemanAsianApproxOption(

+ TypeFlag = "c", S = 100, SA = 100, X = 100,

+ Time = 1/12, time = 1/12, tau = 0 , r = 0.1,

+ b = 0.1, sigma = 0.4)$price

+ print(TW)

+ } else

+ TW <- 2.859122

>

> abline(h = TW, col = 2)

> RollGeskeWhaleyOption(S = 80, X = 82, time1 = 1/4,

+ Time2 = 1/3, r = 0.06, D = 4, sigma = 0.30)

Title:

Roll Geske Whaley Option

Call:

RollGeskeWhaleyOption(S = 80, X = 82, time1 = 1/4, Time2 = 1/3,

r = 0.06, D = 4, sigma = 0.3)

Parameters:

Value:

S 80

X 82

time1 0.25

Time2 0.333333333333333

r 0.06

D 4

sigma 0.3

Option Price:

4.38603

Description:

Sun Dec 01 22:43:35 2019

> BAWAmericanApproxOption(TypeFlag = "p", S = 100,

+ X = 100, Time = 0.5, r = 0.10, b = 0, sigma = 0.25)

Title:

BAW American Approximated Option

Call:

BAWAmericanApproxOption(TypeFlag = "p", S = 100, X = 100, Time = 0.5,

r = 0.1, b = 0, sigma = 0.25)

Parameters:

Value:

TypeFlag p

S 100

X 100

Time 0.5

r 0.1

b 0

sigma 0.25

Option Price:

6.801362

Description:

Sun Dec 01 22:44:09 2019

> Black76Option(TypeFlag = "c", FT = 100, X = 100,

+ Time = 0.5, r = 0.10, sigma = 0.25)

Title:

Black 76 Option Valuation

Call:

Black76Option(TypeFlag = "c", FT = 100, X = 100, Time = 0.5,

r = 0.1, sigma = 0.25)

Parameters:

Value:

TypeFlag c

FT 100

X 100

Time 0.5

r 0.1

sigma 0.25

Option Price:

6.699709

Description:

Sun Dec 01 22:44:09 2019

> BSAmericanApproxOption(TypeFlag = "c", S = 42, X = 40,

+ Time = 0.75, r = 0.04, b = 0.04-0.08, sigma = 0.35)

Title:

BS American Approximated Option

Call:

BSAmericanApproxOption(TypeFlag = "c", S = 42, X = 40, Time = 0.75,

r = 0.04, b = 0.04 - 0.08, sigma = 0.35)

Parameters:

Value:

TypeFlag c

S 42

X 40

Time 0.75

r 0.04

b -0.04

sigma 0.35

TrigerPrice 57.5994499306841

Option Price:

5.270405

Description:

Sun Dec 01 22:44:33 2019

Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

Version 0.4-0 included new data defaults. See ?getSymbols.

> library("SkewHyperbolic", lib.loc="~/R/win-library/3.6")

> mc <- MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000,

+ mcLoops = 50, init = TRUE, innovations.gen = sobolInnovations,

+ path.gen = wienerPath, payoff.calc = arithmeticAsianPayoff,

+ antithetic = TRUE, standardization = FALSE, trace = TRUE,

+ scrambling = 2, seed = 4711)

Monte Carlo Simulation Path:

Loop: No Error in MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000, :

object 'sobolInnovations' not found

> sobolInnovations <- function(mcSteps, pathLength, init, ...) {

+ # Create and return Normal Sobol Innovations:

+ rnorm.sobol(mcSteps, pathLength, init, ...)

+ }

> wienerPath <- function(eps) {

+ # Note, the option parameters must be globally defined!

+ # Generate and return the Paths:

+ (b-sigma*sigma/2)*delta.t + sigma*sqrt(delta.t)*eps

+ }

> plainVanillaPayoff <- function(path) {

+ # Note, the option parameters must be globally defined!

+ # Compute the Call/Put Payoff Value:

+ ST <- S*exp(sum(path))

+ if (TypeFlag == "c") payoff <- exp(-r*Time)*max(ST-X, 0)

+ if (TypeFlag == "p") payoff <- exp(-r*Time)*max(0, X-ST)

+ # Return Value:

+ payoff

+ }

> arithmeticAsianPayoff <- function(path) {

+ # Note, the option parameters must be globally defined!

+ # Compute the Call/Put Payoff Value:

+ SM <- mean(S*exp(cumsum(path)))

+ if (TypeFlag == "c") payoff <- exp(-r*Time)*max(SM-X, 0)

+ if (TypeFlag == "p") payoff <- exp(-r*Time)*max(0, X-SM)

+ # Return Value:

+ payoff

+ }

> TypeFlag <- "c"; S <- 100; X <- 100

> Time <- 1/12; sigma <- 0.4; r <- 0.10; b <- 0.1

>

> mc <- MonteCarloOption(delta.t = 1/360, pathLength = 30, mcSteps = 5000,

+ mcLoops = 50, init = TRUE, innovations.gen = sobolInnovations,

+ path.gen = wienerPath, payoff.calc = arithmeticAsianPayoff,

+ antithetic = TRUE, standardization = FALSE, trace = TRUE,

+ scrambling = 2, seed = 4711)

Monte Carlo Simulation Path:

Loop: No

Loop: 1 : 3.253438 3.253438

Loop: 2 : 2.635154 2.944296

Loop: 3 : 2.6733 2.853964

Loop: 4 : 2.748978 2.827718

Loop: 5 : 2.795612 2.821296

Loop: 6 : 2.904628 2.835185

Loop: 7 : 2.76193 2.82472

Loop: 8 : 2.943871 2.839614

Loop: 9 : 3.628506 2.927269

Loop: 10 : 3.549677 2.989509

Loop: 11 : 2.623178 2.956207

Loop: 12 : 3.26091 2.981599

Loop: 13 : 3.206552 2.998903

Loop: 14 : 3.188396 3.012438

Loop: 15 : 3.080368 3.016967

Loop: 16 : 2.469462 2.982748

Loop: 17 : 2.573869 2.958696

Loop: 18 : 2.736678 2.946362

Loop: 19 : 3.275842 2.963703

Loop: 20 : 2.357823 2.933409

Loop: 21 : 2.6898 2.921808

Loop: 22 : 2.780071 2.915366

Loop: 23 : 2.767824 2.908951

Loop: 24 : 3.090034 2.916496

Loop: 25 : 2.520999 2.900676

Loop: 26 : 2.854595 2.898904

Loop: 27 : 3.274827 2.912827

Loop: 28 : 3.588779 2.936968

Loop: 29 : 2.862528 2.934401

Loop: 30 : 2.987253 2.936163

Loop: 31 : 2.726644 2.929404

Loop: 32 : 2.345068 2.911144

Loop: 33 : 2.849574 2.909278

Loop: 34 : 3.391248 2.923453

Loop: 35 : 2.738561 2.918171

Loop: 36 : 3.244874 2.927246

Loop: 37 : 3.337476 2.938333

Loop: 38 : 2.790049 2.934431

Loop: 39 : 2.308579 2.918383

Loop: 40 : 3.427203 2.931104

Loop: 41 : 2.497448 2.920527

Loop: 42 : 2.562182 2.911995

Loop: 43 : 2.821961 2.909901

Loop: 44 : 2.496715 2.900511

Loop: 45 : 2.627413 2.894442

Loop: 46 : 2.676602 2.889706

Loop: 47 : 2.938307 2.89074

Loop: 48 : 3.024983 2.893537

Loop: 49 : 2.443328 2.884349

Loop: 50 : 3.336588 2.893394

> par(mfrow = c(1, 1))

> mcPrice <- cumsum(mc)/(1:length(mc))

> plot(mcPrice, type = "l", main = "Arithmetic Asian Option",

+ xlab = "Monte Carlo Loops", ylab = "Option Price")

>

> if(FALSE) { # ... requires(fExoticOptions)

+ TW <- TurnbullWakemanAsianApproxOption(

+ TypeFlag = "c", S = 100, SA = 100, X = 100,

+ Time = 1/12, time = 1/12, tau = 0 , r = 0.1,

+ b = 0.1, sigma = 0.4)$price

+ print(TW)

+ } else

+ TW <- 2.859122

>

> abline(h = TW, col = 2)

> RollGeskeWhaleyOption(S = 80, X = 82, time1 = 1/4,

+ Time2 = 1/3, r = 0.06, D = 4, sigma = 0.30)

Title:

Roll Geske Whaley Option

Call:

RollGeskeWhaleyOption(S = 80, X = 82, time1 = 1/4, Time2 = 1/3,

r = 0.06, D = 4, sigma = 0.3)

Parameters:

Value:

S 80

X 82

time1 0.25

Time2 0.333333333333333

r 0.06

D 4

sigma 0.3

Option Price:

4.38603

Description:

Sun Dec 01 22:43:35 2019

> BAWAmericanApproxOption(TypeFlag = "p", S = 100,

+ X = 100, Time = 0.5, r = 0.10, b = 0, sigma = 0.25)

Title:

BAW American Approximated Option

Call:

BAWAmericanApproxOption(TypeFlag = "p", S = 100, X = 100, Time = 0.5,

r = 0.1, b = 0, sigma = 0.25)

Parameters:

Value:

TypeFlag p

S 100

X 100

Time 0.5

r 0.1

b 0

sigma 0.25

Option Price:

6.801362

Description:

Sun Dec 01 22:44:09 2019

> Black76Option(TypeFlag = "c", FT = 100, X = 100,

+ Time = 0.5, r = 0.10, sigma = 0.25)

Title:

Black 76 Option Valuation

Call:

Black76Option(TypeFlag = "c", FT = 100, X = 100, Time = 0.5,

r = 0.1, sigma = 0.25)

Parameters:

Value:

TypeFlag c

FT 100

X 100

Time 0.5

r 0.1

sigma 0.25

Option Price:

6.699709

Description:

Sun Dec 01 22:44:09 2019

> BSAmericanApproxOption(TypeFlag = "c", S = 42, X = 40,

+ Time = 0.75, r = 0.04, b = 0.04-0.08, sigma = 0.35)

Title:

BS American Approximated Option

Call:

BSAmericanApproxOption(TypeFlag = "c", S = 42, X = 40, Time = 0.75,

r = 0.04, b = 0.04 - 0.08, sigma = 0.35)

Parameters:

Value:

TypeFlag c

S 42

X 40

Time 0.75

r 0.04

b -0.04

sigma 0.35

TrigerPrice 57.5994499306841

Option Price:

5.270405

Description:

Sun Dec 01 22:44:33 2019

> CRRTree = BinomialTreeOption(TypeFlag = "pa", S = 50, X = 50,

+ Time = 0.4167, r = 0.1, b = 0.1, sigma = 0.4, n = 5)

> BinomialTreePlot(CRRTree, dy = 1, cex = 0.8, ylim = c(-6, 7),

+ xlab = "n", ylab = "Option Value")

> title(main = "Option Tree")

> model = list(lambda = 4, omega = 8e-5, alpha = 6e-5,

+ beta = 0.7, gamma = 0, rf = 0)

> ts = hngarchSim(model = model, n = 500, n.start = 100)

> par(mfrow = c(2, 1), cex = 0.75)

> ts.plot(ts, col = "steelblue", main = "HN Garch Symmetric Model")

> grid()

> mle = hngarchFit(model = model, x = ts, symmetric = TRUE)

Warning message:

In nlm(.llhHNGarch, par.start, trace = trace, symmetric = symmetric, :

NA/Inf replaced by maximum positive value

> mle

Title:

Heston-Nandi Garch Parameter Estimation

Call:

hngarchFit(x = ts, model = model, symmetric = TRUE)

Parameters:

lambda omega alpha beta gamma rf

4e+00 8e-05 6e-05 7e-01 0e+00 0e+00

Coefficients: lambda, omega, alpha, beta, gamma

lambda omega alpha beta gamma

3.586e+00 3.942e-04 4.147e-05 3.271e-07 0.000e+00

Log-Likelihood:

2480.428

Persistence and Variance:

3.270599e-07

0.0004356557

Description:

Sun Dec 01 23:48:32 2019 by user: ADMIN

> model = list(lambda = 4, omega = 8e-5, alpha = 6e-5,

+ beta = 0.7, gamma = 0, rf = 0)

> ts = hngarchSim(model = model, n = 500, n.start = 100)

> par(mfrow = c(2, 1), cex = 0.75)

> ts.plot(ts, col = "steelblue", main = "HN Garch Symmetric Model")

> grid()

>

> mle = hngarchFit(model = model, x = ts, symmetric = TRUE)

Warning message:

In nlm(.llhHNGarch, par.start, trace = trace, symmetric = symmetric, :

NA/Inf replaced by maximum positive value

> mle

Title:

Heston-Nandi Garch Parameter Estimation

Call:

hngarchFit(x = ts, model = model, symmetric = TRUE)

Parameters:

lambda omega alpha beta gamma rf

4e+00 8e-05 6e-05 7e-01 0e+00 0e+00

Coefficients: lambda, omega, alpha, beta, gamma

lambda omega alpha beta gamma

2.267e+00 2.270e-04 6.071e-05 4.850e-01 0.000e+00

Log-Likelihood:

2419.411

Persistence and Variance:

0.4849522

0.0005586993

Description:

Sun Dec 01 23:49:12 2019 by user: ADMIN

> par(mfrow = c(3, 1), cex = 0.75)

> summary(mle)

Title:

Heston-Nandi Garch Parameter Estimation

Call:

hngarchFit(x = ts, model = model, symmetric = TRUE)

Parameters:

lambda omega alpha beta gamma rf

4e+00 8e-05 6e-05 7e-01 0e+00 0e+00

Coefficients: lambda, omega, alpha, beta, gamma

lambda omega alpha beta gamma

2.267e+00 2.270e-04 6.071e-05 4.850e-01 0.000e+00

Log-Likelihood:

2419.411

Persistence and Variance:

0.4849522

0.0005586993

> hngarchStats(mle$model)

$mean

[1] 0.001266826

$variance

[1] 0.0005587489

$skewness

[1] 0.004965422

$kurtosis

[1] 3.092809

$persistence

[1] 0.4849522

$leverage

[1] 0

$meansigma2

[1] 0.0005586993

$meansigma4

[1] 3.217825e-07

$meansigma6

[1] 1.925689e-10

$meansigma8

[1] 1.209681e-13

> model = list(lambda = -0.5, omega = 2.3e-6, alpha = 2.9e-6,

+ beta = 0.85, gamma = 184.25)

> S = X = 100

> Time.inDays = 252

> r.daily = 0.05/Time.inDays

> sigma.daily = sqrt((model$omega + model$alpha) /

+ (1 - model$beta - model$alpha * model$gamma^2))

> data.frame(S, X, r.daily, sigma.daily)

S X r.daily sigma.daily

1 100 100 0.0001984127 0.01004349

> HNG = GBS = Diff = NULL

> for (TypeFlag in c("c", "p")) {

+ HNG = c(HNG, HNGOption(TypeFlag, model = model, S = S, X = X,

+ Time.inDays = Time.inDays, r.daily = r.daily)$price )

+ GBS = c(GBS, GBSOption(TypeFlag, S = S, X = X, Time = Time.inDays,

+ r = r.daily, b = r.daily, sigma = sigma.daily)@price) }

> Options = cbind(HNG, GBS, Diff = round(100*(HNG-GBS)/GBS, digits=2))

> row.names(Options) <- c("Call", "Put")

> data.frame(Options)

HNG GBS Diff

Call 8.992100 8.939049 0.59

Put 4.115042 4.061991 1.31

> HNG = GBS = Diff = NULL

> for (TypeFlag in c("c", "p")) {

+ HNG = c(HNG, HNGOption(TypeFlag, model = model, S = S, X = X,

+ Time.inDays = Time.inDays, r.daily = r.daily)$price )

+ GBS = c(GBS, GBSOption(TypeFlag, S = S, X = X, Time = Time.inDays,

+ r = r.daily, b = r.daily, sigma = sigma.daily)@price) }

> Options = cbind(HNG, GBS, Diff = round(100*(HNG-GBS)/GBS, digits=2))

> row.names(Options) <- c("Call", "Put")

> data.frame(Options)

HNG GBS Diff

Call 8.992100 8.939049 0.59

Put 4.115042 4.061991 1.31

> Selection = c("Delta", "Gamma")

> HNG = GBS = NULL

> for (i in 1:2){

+ HNG = c(HNG, HNGGreeks(Selection[i], TypeFlag = "c", model = model,

+ S = 100, X = 100, Time = Time.inDays, r = r.daily) )

+ GBS = c(GBS, GBSGreeks(Selection[i], TypeFlag = "c", S = 100, X = 100,

+ Time = Time.inDays, r = r.daily, b = r.daily, sigma = sigma.daily) ) }

> Greeks = cbind(HNG, GBS, Diff = round(100*(HNG-GBS)/GBS, digits = 2))

> row.names(Greeks) <- Selection

> data.frame(Greeks)

HNG GBS Diff

Delta 0.67395339 0.65295993 3.22

Gamma 0.02211149 0.02315963 -4.53

> par(mfrow = c(2, 2), cex = 0.75)

> runif.halton(n = 10, dimension = 5)

[,1] [,2] [,3] [,4] [,5]

[1,] 0.5000 0.33333333 0.20 0.14285714 0.09090909

[2,] 0.2500 0.66666667 0.40 0.28571429 0.18181818

[3,] 0.7500 0.11111111 0.60 0.42857143 0.27272727

[4,] 0.1250 0.44444444 0.80 0.57142857 0.36363636

[5,] 0.6250 0.77777778 0.04 0.71428571 0.45454545

[6,] 0.3750 0.22222222 0.24 0.85714286 0.54545455

[7,] 0.8750 0.55555556 0.44 0.02040816 0.63636364

[8,] 0.0625 0.88888889 0.64 0.16326531 0.72727273

[9,] 0.5625 0.03703704 0.84 0.30612245 0.81818182

[10,] 0.3125 0.37037037 0.08 0.44897959 0.90909091

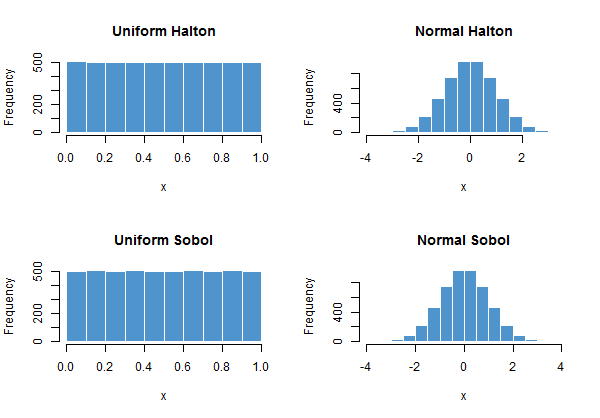

> hist(runif.halton(n = 5000, dimension = 1), main = "Uniform Halton",

+ xlab = "x", col = "steelblue3", border = "white")

> rnorm.halton(n = 10, dimension = 5)

[,1] [,2] [,3] [,4]

[1,] 0.0000000 -0.4307273 -0.8416212 -1.0675705

[2,] -0.6744898 0.4307273 -0.2533471 -0.5659489

[3,] 0.6744898 -1.2206404 0.2533471 -0.1800124

[4,] -1.1503494 -0.1397103 0.8416212 0.1800124

[5,] 0.3186394 0.7647097 -1.7506861 0.5659489

[6,] -0.3186394 -0.7647097 -0.7063026 1.0675705

[7,] 1.1503494 0.1397103 -0.1509692 -2.0453910

[8,] -1.5341206 1.2206404 0.3584588 -0.9811260

[9,] 0.1573107 -1.7861556 0.9944579 -0.5068717

[10,] -0.4887764 -0.3308726 -1.4050716 -0.1282398

[,5]

[1,] -1.3351778

[2,] -0.9084579

[3,] -0.6045854

[4,] -0.3487557

[5,] -0.1141853

[6,] 0.1141853

[7,] 0.3487557

[8,] 0.6045854

[9,] 0.9084579

[10,] 1.3351778

> hist(rnorm.halton(n = 5000, dimension = 1), main = "Normal Halton",

+ xlab = "x", col = "steelblue3", border = "white")

> runif.sobol(n = 10, dimension = 5, scrambling = 3)

[,1] [,2] [,3] [,4] [,5]

[1,] 0.950436354 0.68109632 0.7964227 0.7789565 0.23022611

[2,] 0.505117714 0.10001624 0.5394356 0.1626085 0.29512087

[3,] 0.174511582 0.78909695 0.1558686 0.5312862 0.65873003

[4,] 0.677048266 0.93456304 0.3741792 0.9448425 0.60587275

[5,] 0.002695477 0.23692979 0.9461251 0.3135361 0.46957344

[6,] 0.447998971 0.54445767 0.7023838 0.7443066 0.03626848

[7,] 0.872369766 0.34755683 0.1179214 0.1217073 0.91564041

[8,] 0.418673068 0.05109646 0.2309225 0.9069471 0.13713892

[9,] 0.776573598 0.86932755 0.5893980 0.2873443 0.75079370

[10,] 0.706255794 0.41129673 0.8402236 0.6534177 0.69252151

> hist(runif.sobol(5000, 1, scrambling = 2), main = "Uniform Sobol",

+ xlab = "x", col = "steelblue3", border = "white")

> rnorm.sobol(n = 10, dimension = 5, scrambling = 3)

[,1] [,2] [,3] [,4]

[1,] 1.64909933 0.4707667 0.8289112 0.76867389

[2,] 0.01282859 -1.2814591 0.0990120 -0.98379378

[3,] -0.93648572 0.8032918 -1.0115836 0.07850354

[4,] 0.45946060 1.5106647 -0.3208048 1.59677855

[5,] -2.78269455 -0.7162134 1.6083904 -0.48585188

[6,] -0.13071858 0.1116705 0.5312691 0.65667975

[7,] 1.13766483 -0.3919250 -1.1854420 -1.16649456

[8,] -0.20528928 -1.6343141 -0.7358122 1.32218750

[9,] 0.76067235 1.1232180 0.2259968 -0.56115990

[10,] 0.54247926 -0.2242106 0.9953773 0.39456417

[,5]

[1,] -0.73810241

[2,] -0.53848580

[3,] 0.40899966

[4,] 0.26857795

[5,] -0.07634218

[6,] -1.79573322

[7,] 1.37633104

[8,] -1.09326416

[9,] 0.67698953

[10,] 0.50301041

> hist(rnorm.sobol(5000, 1, scrambling = 2), main = "Normal Sobol",

+ xlab = "x", col = "steelblue3", border = "white")

>

> runif.pseudo(n = 10, dimension = 5)

[,1] [,2] [,3] [,4]

[1,] 0.79259689 0.70324016 0.01059594 0.65264777

[2,] 0.08176445 0.11419372 0.63854853 0.14695273

[3,] 0.43849399 0.82706865 0.66147000 0.86251537

[4,] 0.03803732 0.62726556 0.91649996 0.01114529

[5,] 0.54376884 0.14618442 0.76001064 0.15951197

[6,] 0.51031435 0.05059134 0.75049796 0.84453269

[7,] 0.59332813 0.59546093 0.02149888 0.90612719

[8,] 0.47104987 0.25792078 0.42134953 0.60137007

[9,] 0.67590430 0.55467253 0.14884958 0.39733037

[10,] 0.43858293 0.97749860 0.43211798 0.05088842

[,5]

[1,] 0.76051934

[2,] 0.08410827

[3,] 0.15209821

[4,] 0.98667148

[5,] 0.68380329

[6,] 0.88421234

[7,] 0.85896586

[8,] 0.88135507

[9,] 0.53711930

[10,] 0.49490493

> rnorm.pseudo(n = 10, dimension = 5)

[,1] [,2] [,3] [,4]

[1,] -0.04538924 0.6446193 -0.3001541 -0.23976680

[2,] 0.20136859 -0.3722682 1.4377910 0.92186264

[3,] -0.40949839 -0.2485865 -1.7438494 -0.07028057

[4,] 1.19562289 -1.1394959 1.0015495 -0.31014755

[5,] -1.20001466 -0.1843586 -1.1581102 0.19796954

[6,] 1.60942857 0.4281002 1.9370910 0.15939101

[7,] 2.03454796 1.2277465 0.7349689 -0.20734738

[8,] -1.03831513 1.0760711 -0.6159524 -1.25480079

[9,] -0.07567954 0.8022126 0.1477066 1.56488521

[10,] -0.95910380 -0.8359269 -1.2470675 -0.19151533

[,5]

[1,] 0.6009371

[2,] 0.5307484

[3,] -1.1003838

[4,] -0.8175360

[5,] -0.1659358

[6,] -0.9424639

[7,] 0.6323741

[8,] -1.6318668

[9,] 1.1514525

[10,] -1.4720757

0 Comments