What is option spread trading?

There are 2 important option spread trading in stock market.

Condor spreads

Butterfly spreads

Condor spreads

The major difference is the construction of a Condor

with the butterfly spread the combination of option will consist of three or four unique options based on whether the option are all the same type for the butterfly. In a case where the options are all call or puts there are only three different contracts involved.the iron versions of butterfly space use a combination of two call and to put options with a single strike price being shared by call and put. In case of a Condor there will always before different option is used.

when the spread is constructed with all the same type of options the long version will be created through the purchase of the two outside options and selling the two inside strike options. This is similar to the long butterfly I where the wings are purchased and the middle strike option is actually sold.The short version of of Condor is created through selling the wings and buying the inside options.for example the long version will be covered first and then the short Condor spirit will be discussed in the the next blog.

Long call Condor

A long call Condor x4 call option into account and creates a payoff that reaches the maximum potential profit if the underlying reaches of certain range at expiration.in the case of long butterfly spread at a single point or price at expiration was the gold for initiating the trade.when using a long Condor there is a little bit more room for error as the spreads maximum benefit is from a range of prices.

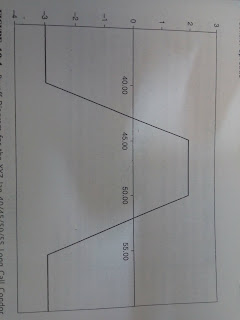

To construct a long call Condor the outside strike price would be purchased. For example using the strike price in the example at the the beginning rupees 40 rupees 45 ,50 and 55long call Kollur food on the 40 and 55 strike call and short the 45 and 50 strike calls. Now to create an example of the long call Condor the goal of this aspirate is for Tata Power which is trading at 40 7.50 presently to settle between 45 and 50 iits at January expiration which is 60 days away. The option value are based on the implied volatility of 30%.

To create a long call Condor with these options the Tata Power Jain 40 call will be purchased for 7.75 and 0.35 will be paid for a long position in the Tata Power Jan 55 called. These two option purchase result in the cost of the two inner strike option are sold selling the Tata Power Jan 45 call for 3.75 and Tata Power 50 cal for these two cells result in a credit to or a trader account of the debit of 8.10 and credit of 5.10 are needed out to result in a cost of 3.0 to enter the Tata Power Jan 40 /45 /50/ 55 long call Condor.

0 Comments