What is theta option?

All exchanges trade options have an expiration date and this time to expirations has an impact on the value of the option. Option contracts are financial instrument that have of finite life. The value of an option is divided into two pieces intensity and time value.

Intrinsic value

The intrinsic value is the value of an option if it is exercised immediately. Example 35 call option with the underlying stock trading at 40 would have an intrinsic value of v.if this 35 call were exercised the stock would be bought at 35 and could be sold in the market for putty and instant profit of dollar 5.any option that is at or out of the money that has no value if exercised will have an intrinsic value of zero. An option cannot have a negative intrinsic value.

In a case where an option has no intrinsic value the total value of option is is time value. The time value is the market value of an option above the intrinsic value of the option. For example using the previous example if the market price of the 35 call option is 7 and the option has five of intrinsic value then the option has two of time value.

Call option with strike price of 35 and the underlying trading at 30 would have low intensity value

If the market price of this option is is 1 then whole 1 premium represent time value. Time value of an option deteriorate has the option moves closer tool the date it expires.expiration and option has no time value and is all intrinsic value if the option has intrinsic value at expiration it will be exercised. If an option has no intrinsic value at expiration it should not be exercised.the loss of time value as an option moves closer to expiration is indicated by the option Greek theta.

Theta

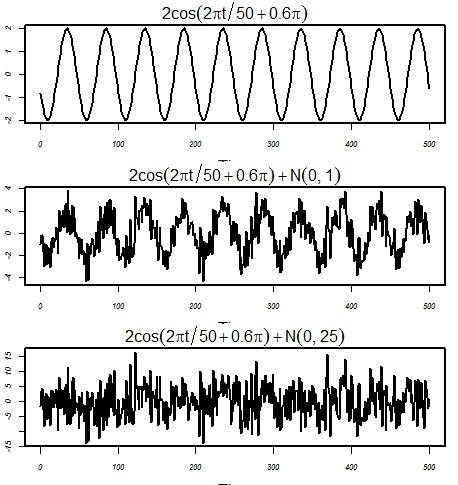

Theta is the amount of value and option will lose over a unit of time. Has the loss of value over time decreases the value of an option over time the theta is displayed on a line has a negative number.the unit of time used to calculate theta can be any things a trader chooses to make it but the most common measures of theta are 1 day or 7 days. At different time throughout out either of these choices may be used depending on the time to experience.

How to analyse the option lose value?

For an hour at themoney option starting at hundred and eighty days to expiration during the first third or 60 days the option would lose 0.33 of value. Indus II of the time to expiration from 102 to 60 days the option loses over the final section of time the last 60 days the option loses 0.99 of value.subdividing the last 60 days event for their the majority of the value 0.70 is lost during the last 30 days.

State forward example of how heater work is if a call or put off sun has a world a theta of .02.all else being the same the option will lose .02 from one day to the next.what is very interesting about theta is how it behave over the life of an option.the loss of time value and at the money option actually occurs in a very nonlinear fashion. In fact the majority of the loss of time value occurs in the last 45 days or so in the life of an option. The option value is based on call option with third strike price 20% volatility and the underlying stock at 30.

Focusing on the in the money option first being in the money the option has 5 of intrinsic value and only .29 of time value with hundred and eighty days left to expiration.with so little time value to start with there is very little available time value to loose from day to day. In fact that ETA is less than .01 a day. The out of the money option has only .33 of value with 180 days to expiration.Like the in the money option since there is very little time value it also loses time value on a minuscule basis from day to day. The theta for this option would also be very low less than .01 per day.

0 Comments