How to analyze the option chain in the derivative market?

In the world of the financial market, it is called a derivative of a financial instrument because its value is derived from different assets like a stock or bond, an option is also a security.

There are two important points about options.

1) when you buy an option you have the right but you have no obligation to execute the contract. So you can always allow the expiration date to go and let the agreement become worthless.

When this happens you lose 100℅ of the investment they used to pay for the option.

2) an option is a contract or agreement that deals with an underlying asset. This is why options are called derivatives which ran the value of the option is derived from something else called underlying assets. The underlying asset is an asset on which the value of the derivative is dependent. In the financial market, most of the time the underlying assets are either stock or index.

There are two types of options call options and put options.

The call option gives the buyer the eight the obligation to buy an asset at a certain price within a certain period of time. The buyer pays a premium to the seller for the right to take delivery of the underlying asset.

Call options are similar to having long positions on security or stock.

A put option gives the buyer the right but not the obligation to sell the underlying at the stated price within a certain period of time. Unlike the call option, the put option buyer also pays a premium for a right to execute the contract.

A put option is similar to having a short position on a stock. Put buyers expect that the stock will fall substantially before the option expires. There are two sides of every option trade and option buyer and option seller.

There are four types of participants in the options market depending on the position

1) call buyers (long positions)

2) call sellers (option writers)

3) put buyers (long positions)

4) put sellers (option writers)

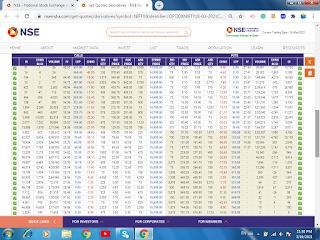

We are looking at the weekly expiry option chain of nifty 18 march 2021 (equity derivative)

At present nifty 50 is at 14910. When we watch the call side of the option chain maximum OI exists at 15200 so this is the resistance which means maximum sellers and buyers are standing at this point.

Similarly, at the put side, 14500 exists with maximum OI so there is a possibility market range between 14500 to 15200 till the next expiry.

0 Comments